Alpha vs Beta: Why They Differ Across Stocks, ETFs, and Funds

Alpha and beta explained — understand how these metrics help assess risk and performance in ETFs and funds.

Markets don’t reward every investor equally. Two people can hold assets with similar returns and still experience very different levels of risk, stability, or market exposure. That’s where alpha and beta come in — two foundational metrics in modern portfolio theory that help you understand how an asset earns its returns, not just how much it earns. This clarifies what alpha truly represents, how it differs from beta, and why these metrics appear differently across various asset types, such as stocks, ETFs, and mutual funds.

What Is Beta? (A Quick Recap)

Beta measures how sensitive an asset is to the overall market’s movements, typically compared against a broad index such as the S&P 500 or the MSCI World.

- β > 1.0 → the asset moves more than the market (more aggressive).

- β < 1.0 → it moves less (more defensive).

- β ≈ 1.0 → it largely follows market trends.

- β < 0 (rare) → it moves inversely to the market.

In practice, beta provides context for volatility:

- A high-volatility asset often has a high beta (amplifies market sentiment).

- A low-volatility asset may have low beta (more insulated from macro swings).

This reinforces the concepts that beta is essentially volatility with direction and market correlation included.

What Is Alpha?

If beta measures risk relative to the market, alpha measures performance relative to a benchmark — answering the question:

Did this investment outperform or underperform what it should have earned for its level of risk?

Alpha isolates the “skill” component of returns:

- Positive alpha (+1% or +3%) → the asset outperformed expectations.

- Negative alpha (–2% or –5%) → it underperformed relative to risk.

- Zero alpha → it performed exactly as expected.

Formula (simplified): Alpha = Actual Return − Expected Return (based on beta and benchmark). Where the benchmark is not arbitrary — it must be formally defined.

Why Alpha Exists for ETFs and Funds — but Not for Individual Stocks

This is the part that often confuses investors.

1. ETFs and mutual funds always have a benchmark

They are built to track or beat a clearly defined index:

- S&P 500

- Russell 2000

- MSCI Emerging Markets

- Sector or style indices

This makes alpha calculation straightforward and consistent.

Example:

If an S&P 500 ETF returns 12% but the index returns 10% after adjusting for beta, its alpha is 2%.

2. Individual stocks do not have an official benchmark

AAPL is not designed to “beat the S&P 500” or “track NASDAQ 100.” It is not a portfolio — it is a company. So if you try to calculate alpha for a single stock, you run into a problem:

- Which benchmark should you choose? S&P 500? NASDAQ 100? Sector index? Global index?

Any choice becomes subjective — and therefore misleading. That’s why major data providers (Yahoo Finance, Morningstar, Reuters, Koyfin) do not calculate alpha for individual stocks. They only publish beta.

3. Alpha without a benchmark loses its meaning

Alpha is only meaningful when the benchmark is formally linked to the asset. This is true for:

- Index ETFs

- Active mutual funds

- Smart beta and factor funds

- Portfolio models

But not for a single company’s stock

Why Beta Still Applies to Stocks

Even though alpha doesn’t apply, beta absolutely does. Stocks naturally move in relation to the broader equity market — some far more than others. For instance:

- High-growth tech stocks often have β = 1.3 to 1.8 (they amplify market trends).

- Defensive utilities or consumer staples often have β = 0.5 to 0.8 (they soften macro shocks).

This is why beta is still a key metric when analyzing stock-level risk, even if alpha is not provided.

Examples: Alpha vs Beta in Practice

Example 1: S&P 500 ETF (SPY)

- Benchmark: S&P 500

- Beta: 1.00

- Return: +11%

- Benchmark return: +10%

- Alpha: +1% (slight outperformance)

Example 2: Active Mutual Fund

- Benchmark: MSCI Europe

- Beta: 0.95

- Return: +7%

- Expected return: +5.5%

- Alpha: +1.5%

Shows fund manager skill (or strategy effectiveness).

Example 3: AAPL (Stock)

- Beta: 1.25

- Return: +14%

No alpha is published because there is no official benchmark against which to compare it. Any alpha estimation would depend on a subjective benchmark selection, which varies widely across platforms and analysts.

How Alpha and Beta Work Together

| Metric | What It Tells You | Applies To |

|---|---|---|

| Beta | Sensitivity to market movement | Stocks + ETFs + Funds |

| Alpha | Skill/strategy vs benchmark | ETFs + Mutual Funds + Portfolios |

| Volatility (Read here about Volatility & Beta) | Magnitude of price swings | All assets |

| Drawdown / Sharpe / Sortino | Risk-adjusted performance | All assets |

Together they provide a full picture:

- Beta indicates how much risk an asset took relative to the market.

- Alpha tells you whether that risk paid off.

- Volatility tells you how turbulent the ride was.

How This Fits Into FinImpulse

FinImpulse delivers a unified, standards-based risk framework across stocks, ETFs, and mutual funds; however, each asset type exposes different metrics depending on its function in financial markets.

Where these metrics live

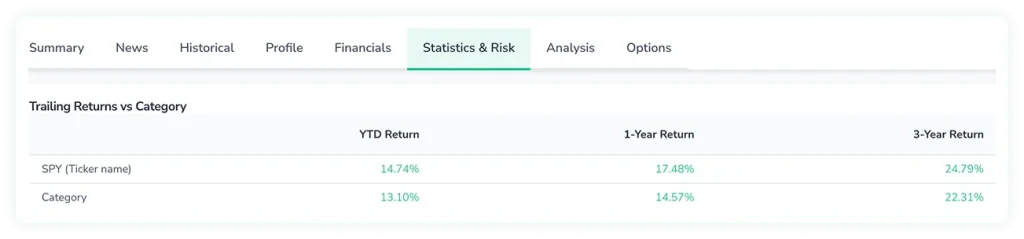

All core market, valuation, and risk indicators are combined inside the Statistics & Risk tab, which includes:

- standard deviation,

- beta (for all asset types),

- alpha (for ETFs and mutual funds only),

- Sharpe and Treynor,

- R-squared and benchmark-linked measures (for funds),

- returns, drawdowns, and historical ranges.

Additional context appears across:

- Summary — headline valuation and price information,

- Historical — time-series data for volatility and returns,

- Financials — fundamentals and financial ratios,

- Analysis — forward-looking indicators and estimates.

This keeps FinImpulse consistent with global providers while giving users a single, consolidated place to evaluate risk.

Beta in FinImpulse

Beta is available for all asset classes, including stocks, ETFs, and mutual funds. Inside Statistics & Risk, users can quickly:

- assess how strongly an asset moves relative to its market,

- compare high-beta and low-beta securities across sectors and regions,

- integrate beta via API into automated models, screeners, or portfolio tools.

Alpha in FinImpulse

FinImpulse calculates alpha only where the metric is valid and industry-standard — namely:

- ETFs, which track explicit benchmarks,

- Mutual funds, which are benchmarked by mandate or category.

Alpha is shown in Statistics & Risk alongside Sharpe, Treynor, R-squared, and category averages. We do not calculate alpha for individual stocks, because:

- stocks have no official benchmark,

- any benchmark choice would be arbitrary,

- this aligns with industry data sources (Morningstar, MSCI, Koyfin, Yahoo Finance).

This ensures FinImpulse never exposes misleading or non-standard metrics.

The Takeaway

FinImpulse follows the global standard for interpreting risk:

- Beta shows how much an asset responds to broad market movement,

- Alpha shows whether a benchmarked ETF or fund outperforms its expected return,

- Stocks display beta but not alpha, because they aren’t benchmark-linked portfolios,

- All risk metrics are consolidated in Statistics & Risk for clarity and consistency.

This provides traders, analysts, and long-term investors with a clear, comparable view of risk — and a deeper understanding of how returns are generated, not just what they are.