Multiple Listings of the Same Company

A clear explanation of why companies trade on several markets and what it means for investors.

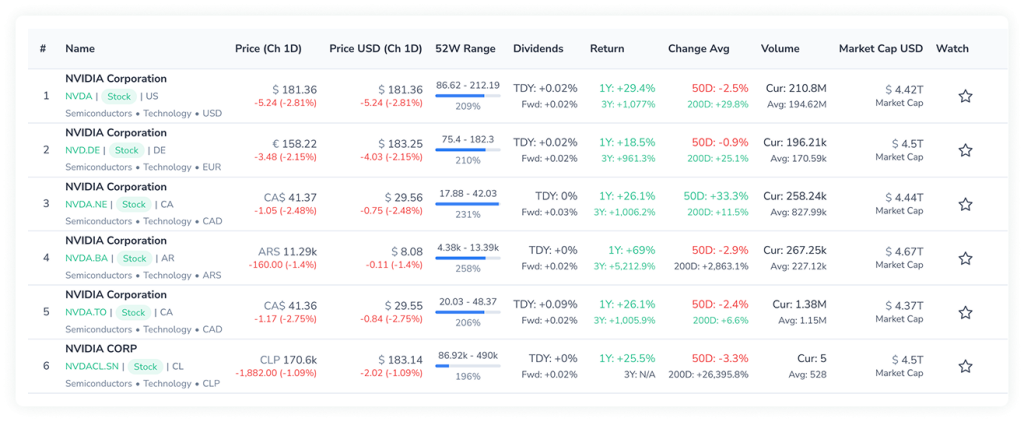

Today, many global companies are listed on multiple stock exchanges, allowing investors worldwide to access their shares in local currencies and markets. Understanding how these listings work can help you make smarter investment decisions.

Global Listings Explained

Large global companies (e.g., NVIDIA, Apple, Microsoft) are often listed on multiple stock exchanges worldwide. There are three main forms of multi-listing:

- Primary listing — the company’s original market (e.g., NVIDIA: NVDA on NASDAQ, US).

- Secondary listings — shares listed on other exchanges, usually in local currencies (e.g., NVDA.TO in Canada, NVDA.BA in Argentina).

- Depositary receipts (ADR/GDR) — certificates traded on international exchanges (e.g., in London or Frankfurt) that represent ownership of the original shares. ADRs (American Depositary Receipts) are primarily traded in the U.S., while GDRs (Global Depositary Receipts) are available on other international markets.

How to identify the main ticker?

- The primary ticker is always tied to the company’s home exchange. U.S. tech stocks → NASDAQ or NYSE

- Secondary tickers include suffixes showing the local market: .TO (Toronto), .BA (Buenos Aires), .BK (Bangkok), .LI (Switzerland)

- All versions share the same ISIN (International Securities Identification Number), which serves as the global identifier for a security.

Not all companies have all three forms of listing; some may only have a primary and depositary listing, or a primary and secondary listing.

Why does FinImpulse show all listings?

Unlike many platforms that only display the primary ticker, FinImpulse reveals all available listings across global exchanges. This has two advantages:

- Local investing options — if you live in Warsaw, you may want to buy NVIDIA shares directly in PLN. FinImpulse helps you see that possibility.

- Complete transparency — you understand how and where the company is traded worldwide, which is especially useful for cross-market strategies.

Practical tips

- Use the primary ticker for global reference.

- Explore secondary listings to check if your local broker offers access in your own currency or market.

- Keep in mind that trading the same company on different exchanges may involve varying fees, different trading hours, and, occasionally, price discrepancies due to currency fluctuations. Liquidity can also differ significantly across exchanges.

FinImpulse Insight

Understanding multiple listings helps investors see the global footprint of companies and identify local opportunities.

We provide the data — you decide what’s right.