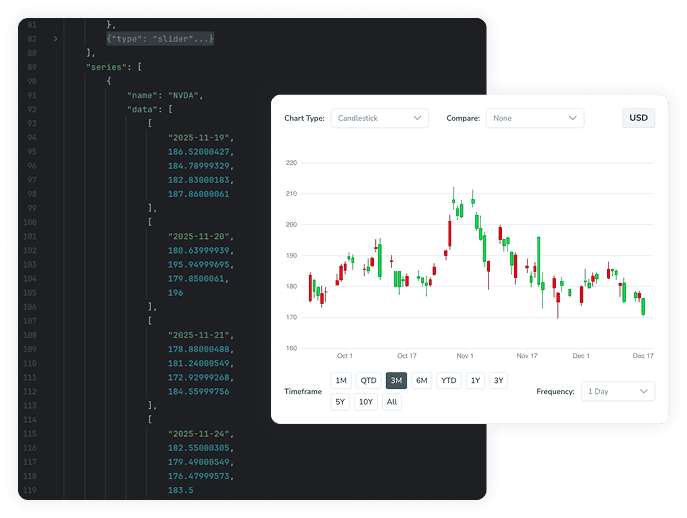

Market Data

Real-time and historical prices, OHLC, volumes, splits, and dividends.

Access real-time and historical market data — prices, fundamentals, holdings, performance, and news — delivered in a consistent, USD-normalized format across global markets.

The API provides structured access to stocks, ETFs, and mutual funds across global markets. All data is normalized, currency-aligned, and delivered through consistent, versioned schemas.

Data is delivered through fast, predictable endpoints with transparent, usage-based pricing.

Everything included in one unified API — no separate modules, no hidden fees.

Real-time and historical prices, OHLC, volumes, splits, and dividends.

Asset metadata, including names, exchanges, currencies, descriptions, sectors, and industries.

Financial statements, valuation ratios, balance sheet, income, and cash flow data.

ETF and fund holdings, portfolio weights, sector, and asset allocations.

Long-term historical time series for prices, fundamentals, and performance metrics.

Market news and press coverage linked to stocks, ETFs, and funds.

Everything included in one unified API — no separate modules, no hidden fees.

Market data, fundamentals, financial statements, holders, insiders, statistics, and risk metrics for global equities.

NAV, market data, full and top holdings, issuer information, returns, risk metrics, and sector weightings.

NAV, performance vs category, holdings, issuer data, ratings, and risk metrics.

Pricing overview for core endpoints available across stocks, ETFs, and mutual funds.

| Endpoint | Description | Billing model | Price |

|---|---|---|---|

| /search | Asset discovery with metadata, identifiers, and current price snapshots. | Hybrid | Call $0.00012 + Row $0.00008 |

| /news | Market news and press coverage linked to assets, including sentiment and timestamps. | Hybrid | Call $0.00012 + Row $0.00030 |

| /historical | Historical OHLCV and adjusted price data with over 20 years of depth. | Hybrid | Call $0.00012 + Row $0.000025 |

Simple, usage-based pricing with no minimums, no subscriptions, and no upfront commitments.

Broad and deep market coverage across stocks, ETFs, and mutual funds with long historical depth.

All prices and historical values are normalized to USD for consistent multi-market comparisons.

Stable infrastructure with predictable latency, consistent schemas, and production-ready endpoints.

Access FinImpulse data via API and use it in spreadsheets, scripts, automation tools, and internal systems.

Get instant access to real-time and historical market data — with transparent pay-as-you-go pricing and no subscriptions.

What you get immediately: